Introduction

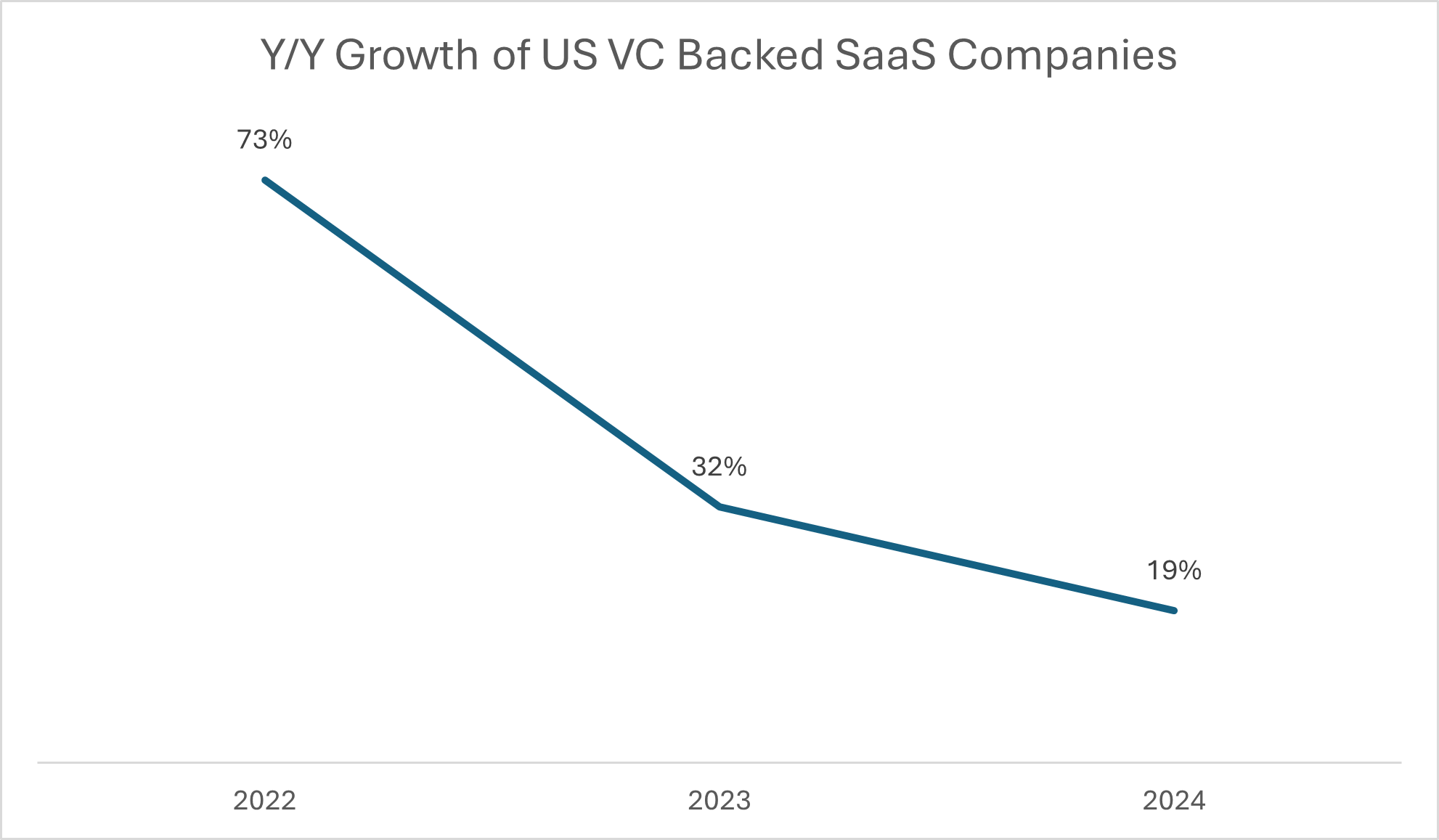

Selling tech got a lot harder the last couple years. According to PitchBook, revenue growth of public US VC-backed SaaS companies, the best and biggest, has fallen sharply since 2022. The top cohort were driving growth of 73% year-over-year in Q1 2022. A year later that growth was down to 32%, in 2024 that growth is down to 19%.

And according to data collected by Sales Science, the top cohort of public companies are adding 36 cents of ARR growth from one dollar of sales and marketing spend.

$0.36 ARR growth from every $1 spent in sales and marketing

If the biggest SaaS brands in the world are finding it harder to grow, and can’t do it efficiently, how are the rest of us supposed to grow, especially without the luxury of a big brand tail wind, big selling teams, or ample cash generated through venture funding or profitability?

This guide is for the rest of us out there.

The cash constrained, resource constrained, B2B Technology companies that want to grow their business, and do so profitably. While no one is denying that there is a ton of competition, according to Gartner, the tech industry is still a growing $5 trillion industry.

According to a recent McKinsey & Co. study, technology companies that achieve ‘Rule of 40’ are valued at double the revenue multiple of the average performing company. What is the Rule of 40 and why is it the best measure of profitable efficient growth?

Popularized by Brad Feld 10 years ago, the Rule of 40 is a metric that states the sum of your year over year revenue growth rate plus your profit margin should exceed 40%.

Rule of 40 = Y/Y Revenue Growth % + EBITDA %

As an example, a company that has an annual growth of 20% and EBITDA of 20% has achieved the Rule of 40. So has a company with 30% growth and 10% EBITDA, and likewise a company with 10% growth and 30% EBITDA, etc.

Why is Rule of 40 so important?

For years, technology companies had access to limitless capital and discounted prices. Even if your company didn’t rely on venture backed financing, your competitor probably did, ultimately having an impact on you. Free funding allowed companies to grow top line revenues without consequence to how much cash they burned. However, in post 2022 tech world, the companies that are rewarded are the ones that can achieve growth without burning cash to do so.